A Conventional Loan is a mortgage that’s not backed by the government. It typically follows the rules set by Fannie Mae or Freddie Mac.

There are two types:

-

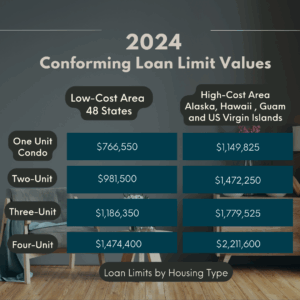

Conforming loans – meet Fannie Mae/Freddie Mac guidelines

-

Non-conforming loans – don’t meet those guidelines, but are still considered conventional.

Conventional loans can be used to buy or refinance a primary home, second home, or investment property.

✅ Requirements

To qualify, lenders typically look at:

-

Credit Score: 620+ is ideal

-

Debt-to-Income Ratio: 28% for housing, 36% for total debts (can go higher with strong financials)

-

Income & Credit History: Stable income and a good payment track record

💰 Down Payment

You’ll usually need to put down 5% to 20% of the home’s price.

💸 Interest Rates

Your rate depends on your loan type and credit score.

Conventional loans come in two main types:

-

Fixed-rate: Same payment for the life of the loan

-

Adjustable-rate (ARM): Lower rate to start, but it can change over time

🏠 Eligible Properties

You can use a conventional loan to buy:

-

Single-family homes (1–4 units)

-

Condos, townhomes, modular, and some manufactured homes

-

Primary homes, vacation homes, and rental properties

🔄 After Bankruptcy?

You may qualify:

-

Chapter 7: After 4 years

-

Chapter 13: After 2 years of re-established credit

👉 Need help figuring out if a Conventional Loan is right for you? I’ll help you explore every option available.

📞 Call me (510)-542-7834 today!

📞 Call me (510)-542-7834 today!

Tina Bui – Your Trusted Mortgage Advisor

Call Tina (510) 542 7834 today!